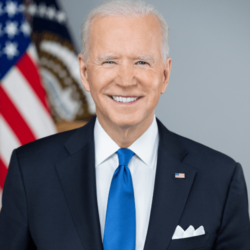

WASHINGTON, D.C. (NAFB) – President Biden’s nominee for Treasury’s tax policy chief got asked about Biden’s proposal to end the stepped-up basis on family farms and replace it with a capital gains transfer tax.

Lily Lawrence Batchelder appeared before the Senate Finance Committee and was quickly confronted with President Biden’s plan to replace the stepped-up basis with a straight capital gains tax at death.

Lawrence Batchelder conceded those earlier proposals to replace stepped-up basis with carry-over basis were repealed but claimed one in 2010 did not have any major problems. Still, Iowa GOP Senator Chuck Grassley argued the Biden plan could still pose problems figuring basis after the owner of a family farm held for generations passes away.

Separately, Biden U.S. Trade Ambassador Katherine Tai Tuesday requested a dispute settlement panel to resolve U.S. complaints that Canada’s failed to live up to its USMCA dairy commitments. Dairy groups and lawmakers hailed the move that could result in U.S. retaliatory duties if Canada fails to provide agreed-to access to its dairy market.