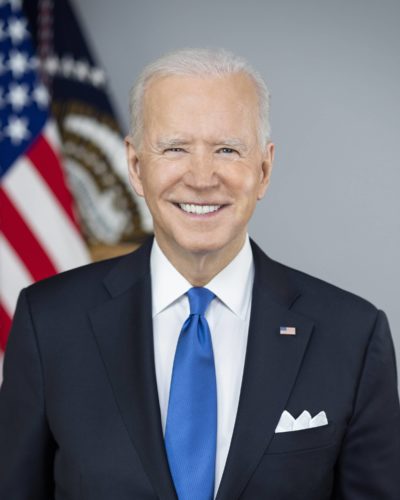

(NAFB) – Ahead of Wednesday night’s joint session of Congress address by President Joe Biden, the White House released details of the American Families Plan.

The bulk of the $1.8 trillion package focuses on education, direct support to low- and middle-income families and extending tax breaks to families with children. Biden plans to end other tax breaks to pay for the package, including stepped-up basis.

However, Biden says, “The reform will be designed with protections so that family-owned businesses and farms will not have to pay taxes when given to heirs who continue to run the business.”

American Farm Bureau Federation Economist Veronica Nigh recently explained, “A long-standing provision of U.S. tax law is that a capital gains tax is not imposed when assets are transferred at death to an heir. Furthermore, tax law allows the heir to increase their basis in the asset to fair market value without paying capital gains tax,” which is referred to as a step-up in basis.